Part B also covers vaccines needed to treat certain injuries or if you have direct exposure to a disease.

Medicare copay 2023 free#

Others are covered by Part D prescription drug plans and require beneficiaries to pay some of the cost.įor example, shots for the flu, pneumonia, COVID-19 (initial shots and boosters) and hepatitis B for some enrollees are free under Part B and that coverage will continue in 2023.

Some vaccines are covered under Part B and are already free to Medicare enrollees. Free vaccinesĪlso under the new law, vaccines recommended for adults by the Centers for Disease Control and Prevention’s Advisory Committee on Immunization Practices (ACIP) will be available to Medicare recipients with prescription drug coverage free of charge. So although the monthly maximum copay for insulins covered by Medicare will be $35 in 2023, 20, beginning in 2026 - the first year negotiated prices will take effect - covered insulin copays for any drugs that have been part of the new negotiations will be $35 or 25 percent of the negotiated price, whichever is less. Note that not every plan covers every type of insulin.īeginning on July 1, Medicare enrollees who take their insulin through a pump as part of the Part B durable medical equipment benefit will not have to pay a deductible and they will also benefit from the $35 copay cap.Īnother provision of the new law calls for some high-priced drugs to be subject to price negotiation with drugmakers. Enrollees won’t have to pay more than $35 even if they have not yet met their annual Part D deductible. Under the Inflation Reduction Act of 2022, which includes a number of provisions to lower the prices of prescription drugs for Medicare beneficiaries, beginning in 2023 copays for a 30-day supply of any insulin that a Medicare drug plan covers will be capped at $35. Beneficiaries with Medicare Advantage plans should check with their plan for hospital charges.

Medicare copay 2023 full#

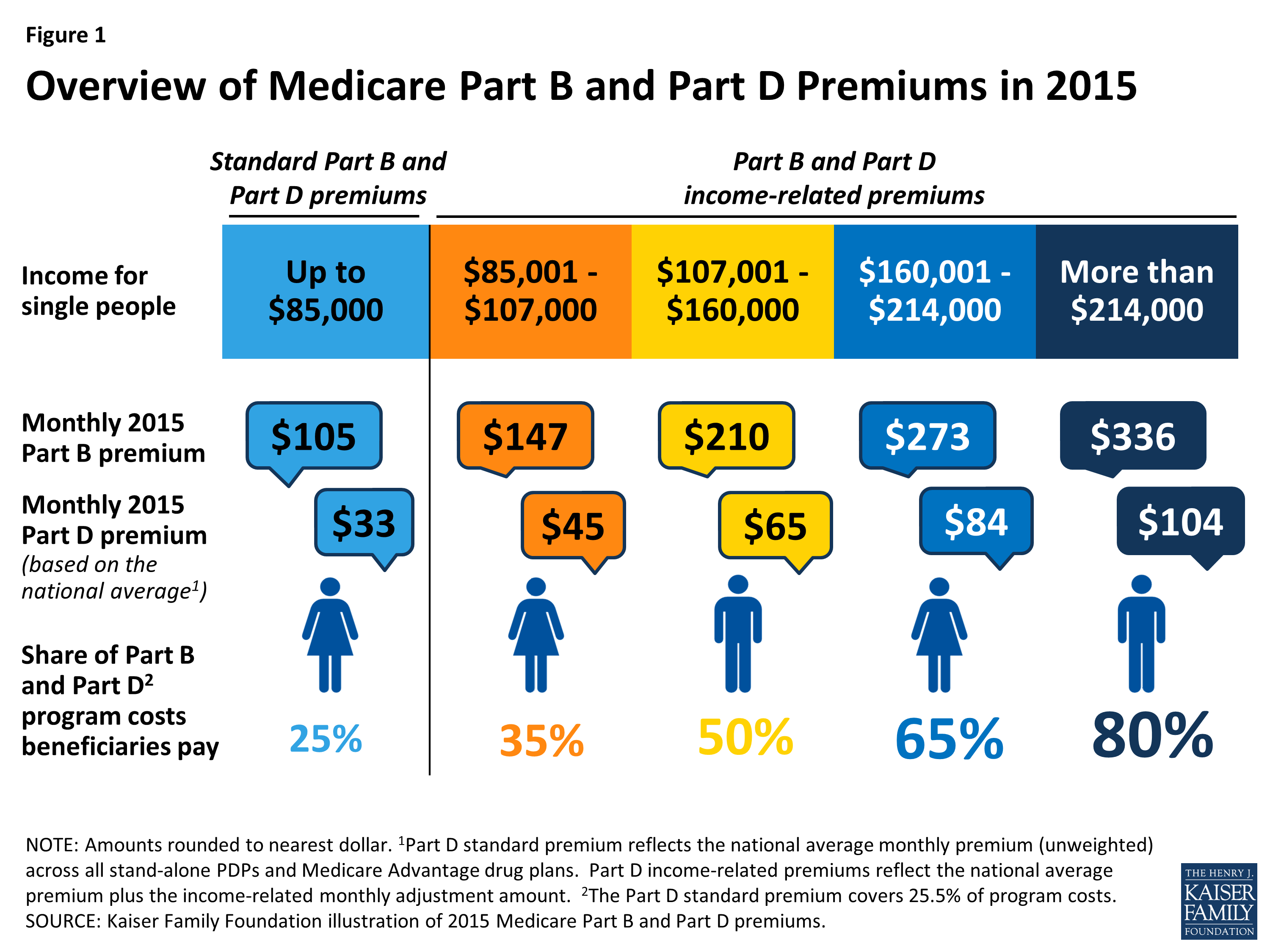

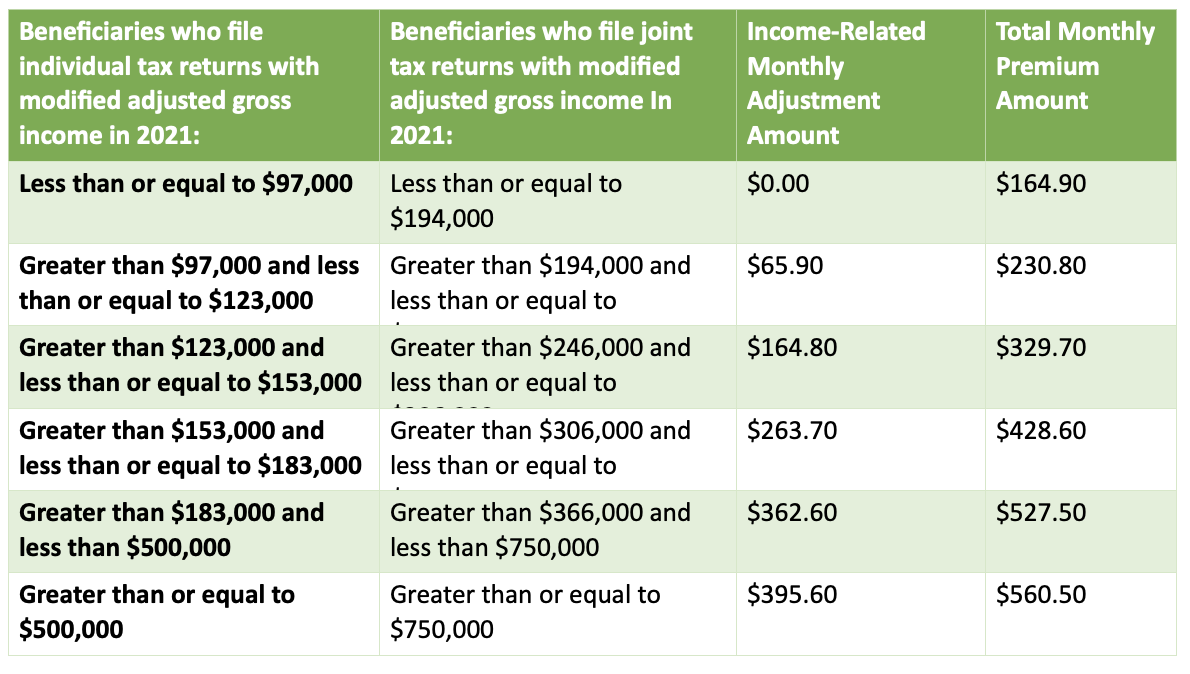

Whether a beneficiary must pay the full Part A premium depends on their or their spouse’s work history. The full Part A premium will be $506 a month in 2023, a $7 increase. For those people who have not worked long enough to qualify for premium-free Part A, the monthly premium will also rise. While most Medicare enrollees do not pay a monthly premium for Part A, which covers inpatient hospital, skilled nursing facility, hospice and some home health care services, a deductible is charged for each hospital stay.įor 2023, the Part A deductible will be $1,600 per stay, an increase of $44 from 2022. Part A costs increasingĪ fixed cost in Medicare that is going up is the Part A deductible. That limit is $5, compared with $480 in 2022. The government does set a limit on Part D deductibles. The annual Part B deductible for 2023 is decreasing to $226, a $7 decline from 2022 and the first drop in a decade.Īnnual deductibles in Medicare Advantage plans and stand-alone Part D prescription drug plans vary by what plan you pick and where you live. Some of these private plans do offer a “giveback” benefit in which the insurer covers part or all of a member’s Part B monthly premium. Most Medicare enrollees must pay the Part B premium whether they have original Medicare or an MA plan. Experts expect half of all Medicare enrollees selected an MA plan for the new year. Premiums for high-income beneficiaries started at $238.10 in 2022.Įnrollment in Medicare Advantage (MA), the private health insurance alternative to original Medicare, is likely to continue growing in 2023. For example, someone filing an individual tax return whose income is between $97,000 and $123,000 will pay $230.80 a month for Part B. Part B beneficiaries with annual incomes greater than $97,000 will pay more than the standard premium - exactly how much more will depend on their income. The higher monthly charges paid by 7 percent of Medicare beneficiaries with high incomes also will decline in 2023. With Social Security’s cost-of-living adjustment (COLA) increasing benefits by 8.7 percent in 2023, Americans who are enrolled in both programs will see more money in their pockets each month. Here’s a closer look at the biggest changes coming to Medicare in 2023.įor most Medicare beneficiaries, Part B premiums are deducted directly from their monthly Social Security payments. “All the work that we’re doing is to make care more accessible for them, make it work better and make it more affordable.” “We are keeping the more than 65 million people in the Medicare program at the center of everything we do,” Meena Seshamani, a surgeon, health economist and director of the federal Center for Medicare, told AARP in an interview.

0 kommentar(er)

0 kommentar(er)